Western Australian Treasury Corporation (WATC) is the central borrowing authority for Western Australia. Investors in our debt securities benefit from the guarantee of all financial obligations provided under the Western Australian Treasury Corporation Act 1986, by the Treasurer on behalf of the State of Western Australia. All payments of interest during the term of an investment and the repayment of principal at maturity are guaranteed by the State of Western Australia.

Why Choose WATC?

The financial liabilities incurred or assumed by WATC are guaranteed by the Treasurer on behalf of the State of Western Australia.

WATC is responsible for raising funds on behalf of the State of Western Australia. At 30 June 2024, WATC’s total debt amounted to $50.4 billion.

WATC’s borrowings are afforded strong credit ratings, being rated AAA by S&P Global Ratings and Aaa by Moody’s Ratings.

At WATC, we undertake wholesale funding activities through a range of debt facilities in both domestic and overseas financial markets, to source funding for our borrowing program.

Via these facilities, we conduct debt issuance through individual dealer panels comprised of a select number of key financial intermediaries in the relevant markets. WATC accesses funding through the following established borrowing facilities:

- Domestic A$ Benchmark Bonds

- Domestic A$ Floating Rate Notes (FRN)

- Domestic Short-Term Notes

- Euro Medium Term Notes (EMTN)

- Euro Commercial Paper (ECP).

Our primary source of long-term funding is the domestic fixed interest market. Long-term funding, mainly through domestic benchmark bonds, comprises approximately 75 per cent of total borrowings.

WATC is also a key participant in domestic and offshore short-term markets, issuing short-term notes and ECP for liquidity funding. Subject to borrowing program requirements we explore opportunities to issue through our EMTN Program to generate term fixed and floating rate funding.

- Borrowing ProgramLearn more

Our new money program and funding strategy.

- Funding SourcesLearn more

Our funding sources including both domestic and offshore solutions.

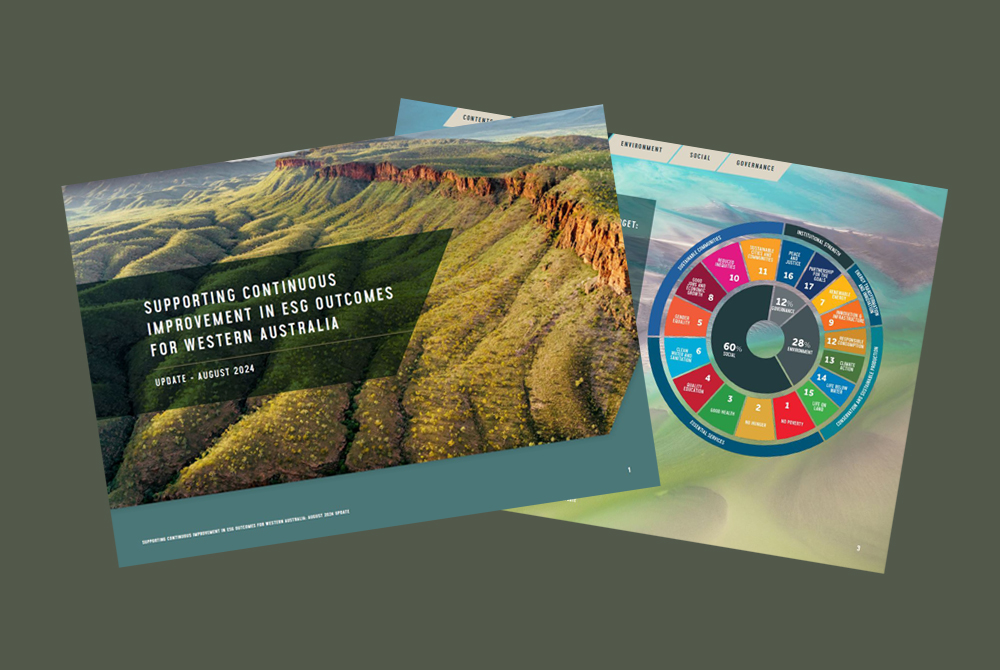

- Sustainable Finance ProgramLearn more

Our structure to finance environmental, social and governance initiatives.

- Dealer PanelLearn more

Our distribution network.

- Investor Term SheetsLearn more

Details of our syndicated issues.

- Weekly Issuance UpdatesLearn more

A summary of Benchmark Bond and Floating Rate Note activity.

Banner image top - Kings Park and Botanic Garden. Image courtesy of Tourism Western Australia.

ESG Outcomes

Find out how Western Australia is supporting continuous improvement in environmental, social and governance outcomes.